Savings that grows with your startup

Unleash your potential

Building the future of fintech together

Banking-as-a-Service (BaaS)

Corporate API Banking

Payment Facilitation

Best-in-class partners

Banking & technology leaders invested in your success

Building the future of fintech together

Easy Online Account Opening

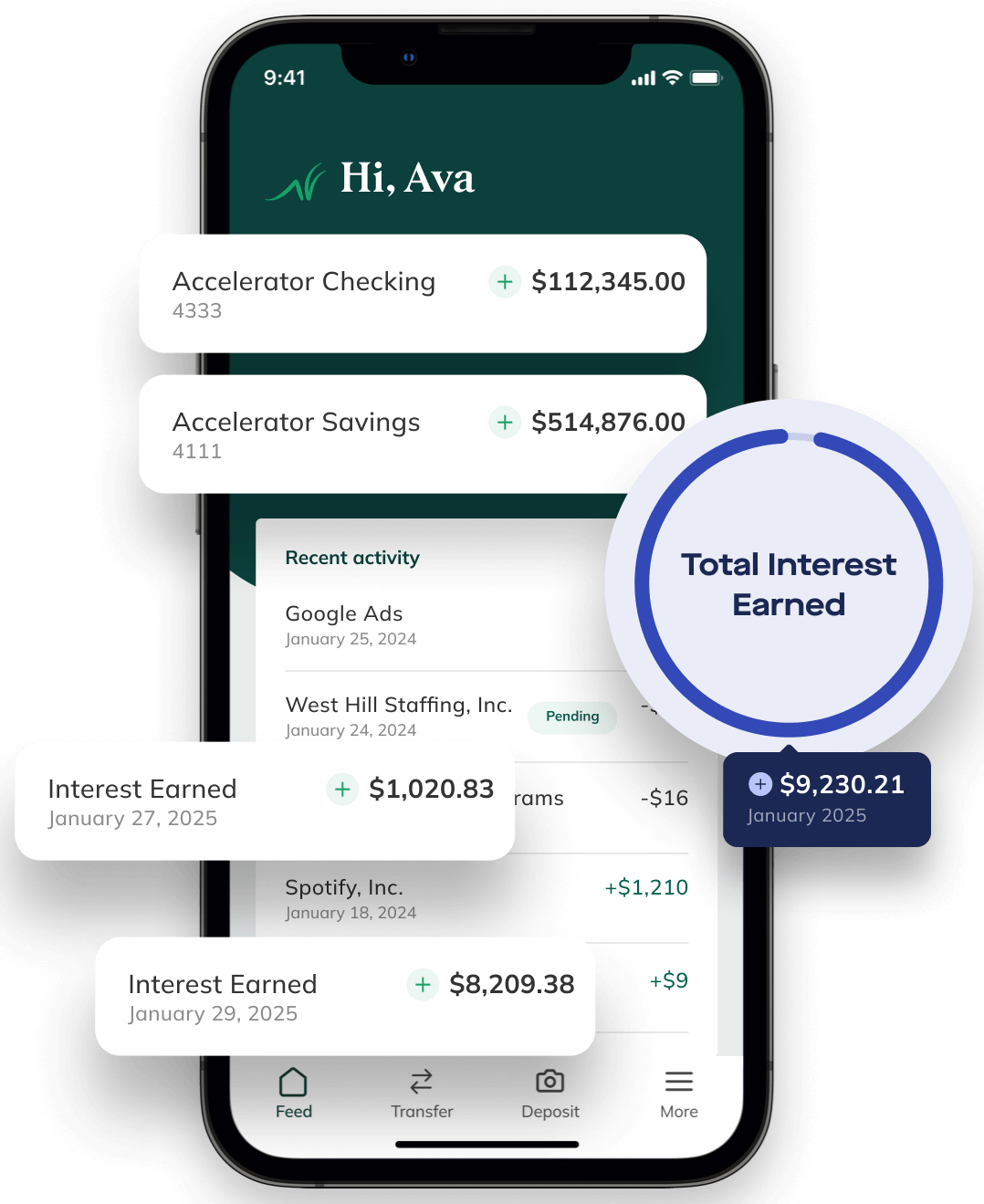

High-Yield Deposit Accounts

Enhanced FDIC Insurance

Ultimate Flexibility

No Hidden Fees

Protection you can trust

Industry-leading security measures for extra peace of mind

Why partner with us?

Established Infrastructure

Regulatory Compliance

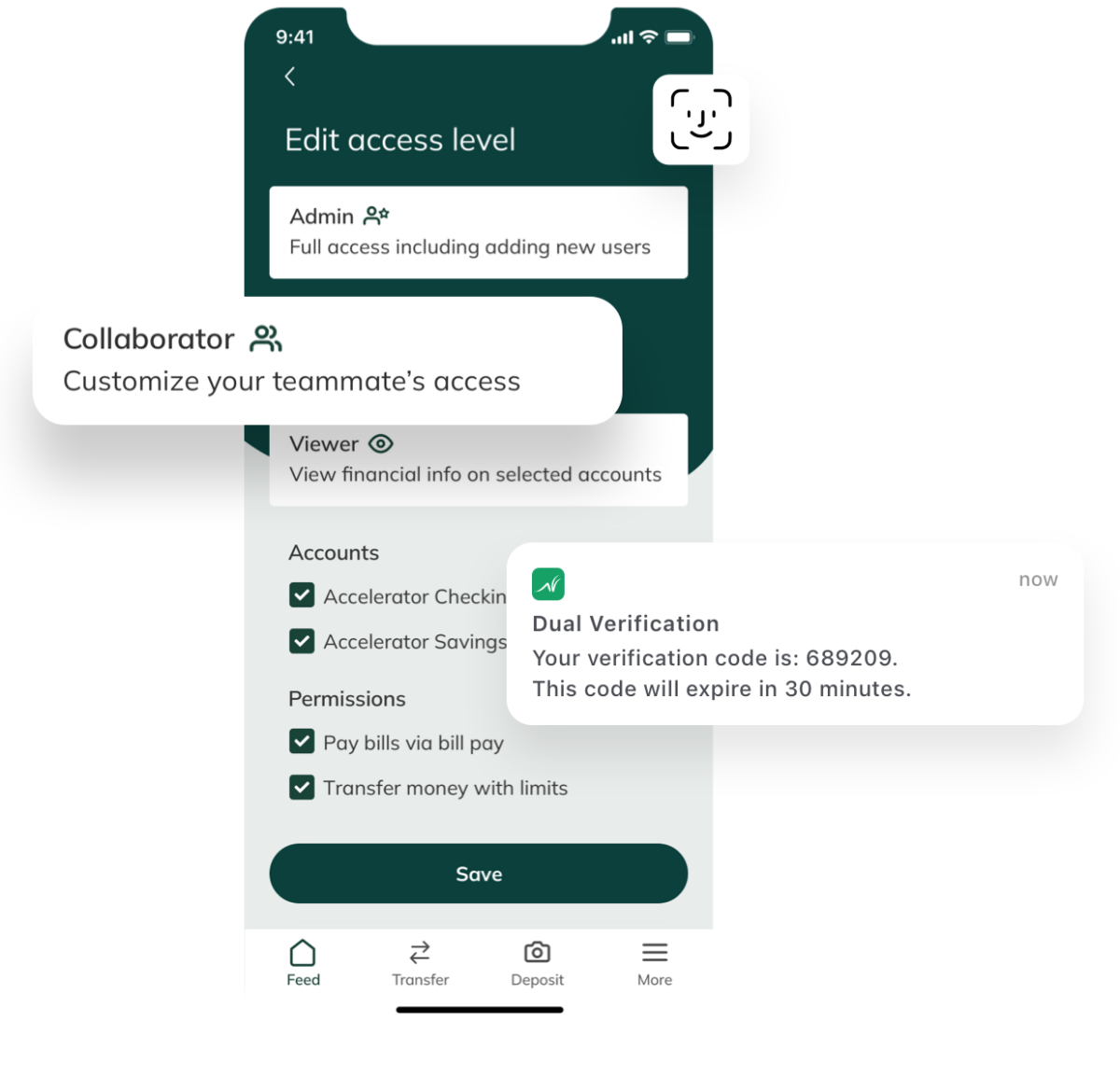

Advanced Security Measures

Advanced Security Measures

Frequently Asked Questions

Accelerator Checking is available to all startup companies that are in growth mode—whether you plan to raise growth capital, have already secured funding from investors, or are actively scaling. This account is not available to businesses in the following industries: adult entertainment, gambling, illegal substances, virtual currency, or weapons and firearms.

To open an account, you must be 18 years of age or older and a U.S. citizen or permanent U.S. resident with a verifiable address in one of the 50 states or District of Columbia. U.S. Territories, including Puerto Rico, are ineligible. Other restrictions may apply.

For full terms and conditions, please refer to our Master Service Agreement.

Many banks offer the option of opening a bank account online or in person. Whatever process you choose, the documentation needed is generally the same. Below you will find a list of information that you will need to provide to open an Accelerator Checking Account.

Company Information

- Type of legal entity

- Legal name of entity

- EIN/Tax ID number

- State of Registration

- Month/year established

- Company phone number

- Company description

- Company address

Applicant Information

- Legal name

- Job title

- Ownership %

- Physical Address

- Email address

- Phone number

- Date of birth

- SSN/Tax ID number

Owners/Authorized Signers/Control Person

- Legal name

- Job title

- Ownership %

- Email address

- Physical address

- Phone number

- Date of birth

- SSN/Tax ID number

Beneficial owner information will be required for each individual who owns 25% or more, directly or indirectly, of the company.

When opening an Accelerator Checking account, we will ask for a minimum deposit of $100. Initial funding deposits are provided by manual ACH or linking to an external account at another financial institution via Plaid.

Once you’ve been approved and the account is open, the funds for your initial deposit will be made available within 5 business days beginning on the first day that the funds are posted to your account. Although an initial funding deposit is required to open an account, there are no monthly fees or minimum balance requirements.

For more information, please refer to our Accelerator Checking Fee Schedule.

To maximize your earnings potential, we recommend leveraging the Accelerator Product Suite. Accelerator Checking offers a tiered APY structure based on your balance:

1.00% APY for balances between $0.01 and $24,999.99

1.55% APY for balances between $25,000 and $250,000

1.00% APY for balances above $250,000.01

However, to truly maximize your earnings, aim for a balance of $25,000 or more in your Accelerator Savings Account, which qualifies for a competitive rate of 3.30% APY. By leveraging the Accelerator Product Suite, you can make the most of your funds while enjoying the flexibility of both accounts.

Note: Rates may change after the account is opened, and fees may reduce earnings.

One of the benefits of choosing Grasshopper as your primary financial institution is that you can avoid the hidden fees that are often associated with traditional banking.

When opening an Accelerator Checking account, we do require a minimum deposit of $100. However, there are no monthly fees or minimum balance requirements once the account is open.

For more information, please refer to our Accelerator Checking Fee Schedule.

As a digital-first bank, we provide powerful digital tools to easily deposit checks from your mobile device. We do not offer cash deposits at this time.

For more information about manual check processing or assistance with mobile check deposit, please reach out to Client Services.

At this time, we do not support Zelle as an integration. However, we have partnered with Plaid to provide our clients with a safe way to connect their checking accounts to other modern payment apps within their network.